2025 U.S. Governance Post-Season Review: Evolving Priorities in a Shifting Landscape

Key Takeaways

- Political, legal, and regulatory changes contributed to an altered landscape for governance, DEI and sustainability issues;

- “Traditional” skills appeared to be on-trend for directors;

- Directors with significant outside board commitments have declined while investor support for overboarded directors improved;

- Investors may be reassessing lengthy tenure; vote outcomes suggest more leniency on this topic;

- Shareholder proposal volume significantly declined, with a quarter submitted ultimately omitted from proxy ballots; governance proposals dominated the season.

The dynamic 2025 proxy season was marked by significant shifts for issuers and shareholders alike. Political, legal, and regulatory changes left market participants scrambling to adapt and adjust, all while navigating market uncertainty and volatility during the height of proxy season. Against this backdrop, shareholder support for director elections continued to rise from a low point during the pandemic.

While boards continued to have diverse representation despite increased pushback against diversity, equity, and inclusion initiatives, the attributes of incoming directors showed a greater emphasis on more traditional skills and expertise. Meanwhile, investor attitudes may be changing toward other issues such as directors’ commitments to several companies or what is considered an overly long tenure.

The steep drop in environmental, social, and political contribution shareholder proposals to make the ballot meant that governance proposals continued to dominate, particularly those aimed at improving shareholder rights. The debate over reincorporation to states with less stringent shareholder protections than Delaware captured a lot of attention, but only a few companies have proposed to do so.

The 2025 proxy season demonstrated a continuation of long-term trends as well as sharp and dramatic shifts in investor and corporate behavior, providing a great deal for shareholders and issuers alike to examine going forward.

Director Elections

Investor Support on Director Elections Continues to Increase

Director vote support rebounded from the 2023 trough for both general board members and committee chairs. Notably, the gap in overall director support between the Russell 3000 and S&P 500 narrowed in 2025 after widening across the 2021–2024 seasons.

Governance Committee Chairs – frequent targets for investors as an outlet regarding corporate governance practices – continued to receive the lowest level of median support across the Russell 3000 at 94.3% support in elections held between Jan. 1 and June 30, 2025. That compares with 97.8% overall director support during the same period. Sustainability Committee Chairs continued to attract in the second lowest level of support, as they have since FY 2023.

Resistance to Outside Commitments Eases, But Remains Strong

While support levels in 2025 rallied for elections overall, backing remained low for directors with significant outside commitments. Historically, investor skepticism surrounding director bandwidth has swelled with each additional outside public board commitment. This season was no different; however, non-executive directors serving on four or more public boards saw increases in median support this season, up 1.5%, 4.9%, and 5.8% for four, five and six or more contemporaneous seats, respectively, from 2024.

However, the apparent rise in support is probably a red herring. The number of non-employee directors serving on several public company board seats contemporaneously indicates responsiveness to the same investor sentiment: that directors have adequate time and attention to fulfill the responsibilities of each company’s board. Between the 2024 and 2025 seasons, the number of directors serving on four, five, and six or more public board seats has declined by 14%, 34%, and 33%, respectively. Those serving on only a single board seat represented 52.8% of all directors in 2025, up from 51.5% in 2024.

Tolerance for Lengthy Tenured Directors May be Improving

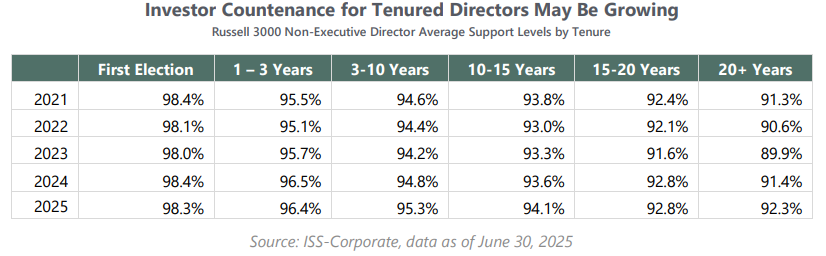

In keeping with prior years, support was typically stronger for public company non-employee directors being elected for the first time than for longer-tenured colleagues. During an inaugural appointment, investors are less likely to hold new class members responsible for any ongoing issues. Initial support tends to fade over time, and this dynamic did not change in 2025.

As with the overall director support, backing for longer serving non-employee directors improved from a 2023 trough, but at a much faster rate. The extent of improvement from 2023 was the highest among 20+ year tenured directors (2.4% compared to 0.3% – 1.2% for other groups), suggesting that investors’ tolerance of long-tenured directors may be increasing.

The overall mix of longer-tenured directors, on the other hand, has remained largely stable over the past five years. The larger changes were instead seen in the earliest three years of a director’s incumbency as well as the three-to-10-year range.

Board Composition Shifts Are Underway

The rate of directors under 55 joining boards declined across indexes, aligning with higher support for longer-tenured directors. Demographics shifts were evident in newly elected director skills: leadership, financial expertise, and CEO experience saw the largest increase, while newer-age skills such as information security and CIO experience showed little growth and ESG skills became less common. The emphasis on traditional skills likely reflects boards’ shifting priorities back to core financial and business expertise. However, this focus may result in gaps in board readiness to address emerging risks.

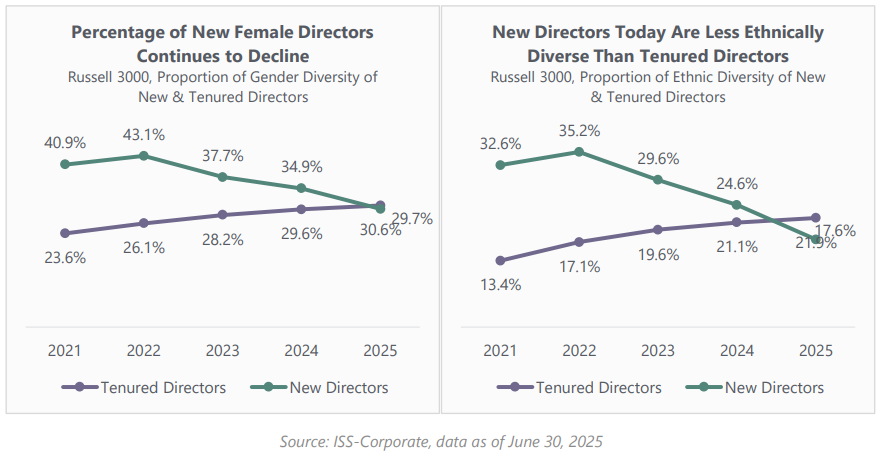

The momentum behind appointing racially, ethnically, and gender diverse new directors to public company boards likewise slowed this season. Although diverse racial/ethnic representation is up by 20% and female representation up 18% in the last five years for Russell 3000 companies, the percentages of diverse tenured directors exceeded that of new diverse directors for the first time in the same period. This decline follows a 2022 peak in new class member diversity and may affect overall board composition numbers in the coming years.

Board Chair Independence Continues to Take Hold

Prevalence of independent board chairs across indexes rose steadily over the past five years, with a rapid acceleration in 2023, in parallel to a spike in Independent Board Chair shareholder proposals over the 2022 and 2023 seasons. In 2025, Independent Chair prevalence reached five-year highs of 38.6% in the S&P 500 and 46.7% in the Russell 3000 (S&P 500 exclusive).

Board Independence Remains Consistent with Limited Exceptions

Overall board independence remained broadly consistent, with exceptions in some sectors. Consumer Discretionary returned to its prior levels following a 2% dip in 2022 while Consumer Services and Consumer Staples recorded their largest increases since 2021, rising about 3% and 4% respectively.

Materials was the only sector to show a negative trend, with independence declining by nearly 2% since 2021, a development that may reflect industry ownership structures, company size characteristics, or a preference for retaining directors with sector-specific expertise.

Shareholder Proposals

Overall Submissions Decline

The total volume of shareholder proposals submitted has decreased significantly, driven by a sharp decline in those related to environmental or social issues. The limited success of such proposals in recent years, improvements in corporate disclosure, increased political pushback, and an SEC policy change all likely contributed to the drop in submissions.

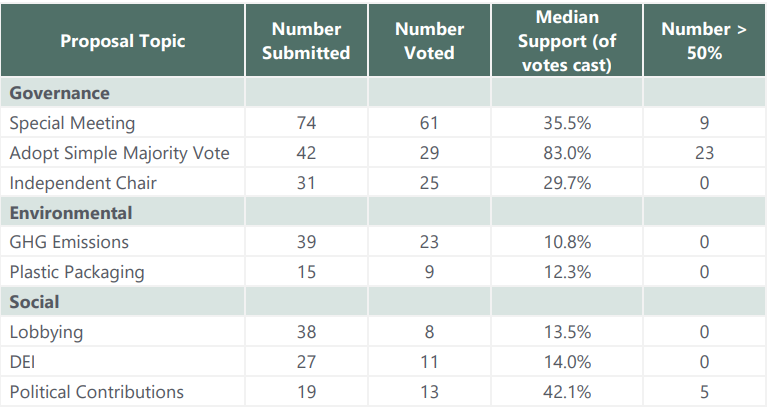

Governance resolutions were the most submitted proposal and remained the main focus for both proponents and investors. Among the 50 resolutions that received majority support of votes cast in 2025, 45 focused on governance issues, mostly shareholder rights.

Nearly a Quarter of All Shareholder Proposals Omitted

Omitted shareholder proposals increased dramatically to nearly 24% of the total submitted, from about 15% as of the same period in 2024. The U.S. Securities & Exchange Commission’s (SEC) Staff Legal Bulletin (SLB) No. 14M (CF), which reinstated a requirement that shareholder proposals demonstrate a clear nexus to a company’s core business, was likely a significant factor in the year-over-year increase in omissions.

Lobbying and political contribution shareholder proposals stand out, given both the relatively high volume of omissions and noteworthy shareholder support for those that did make it to the ballot. Historically, most lobbying and political contribution proposals went to a vote. In 2025, however, 59 proposals on these two topics were submitted and 20 were omitted, compared to just three resolutions omitted last year. Despite the number of omissions, the median vote outcome on political contribution shareholder proposals is notable, at 42%.

- Lobbying proposals generally request a report on the company’s policy and procedures around lobbying, payments, membership, and Board oversight of this topic.

- Political contribution shareholder proposals generally request a report disclosing policies and procedures related to political contributions and payments

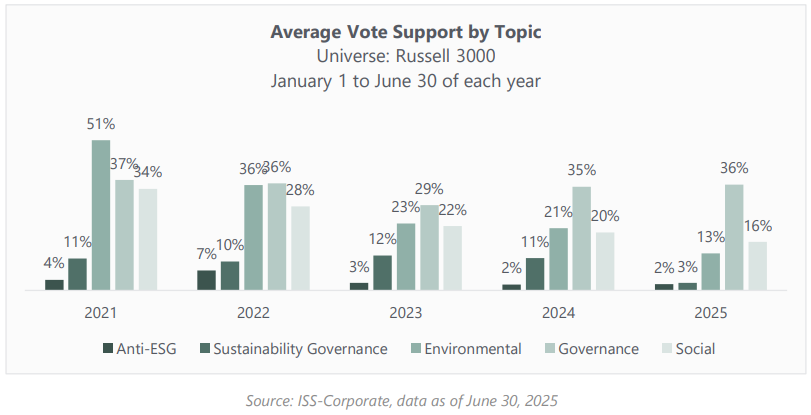

Governance Proposals Support Steady While Others Decline

Governance proposals continue to receive the strongest level of shareholder support, and average support remained steady year-over-year. Environmental proposals experienced the largest drop in average support; social proposals saw a moderate decline. As has been the case for years running, the average vote outcome on anti-ESG proposals remained in the single digits.

Top Shareholder Proposal Vote Outcomes

Similar to prior years, the most common proposals submitted, voted on, and receiving majority support related to enhancing shareholder rights. On social matters, the only proposal topic to receive majority support was political contributions, and five such resolutions received more than 50% support. Notably, no environmental proposals received majority support. This was likely due to a variety of factors, such as improved corporate practice, proposals becoming too onerous or restrictive, political sensitivity surrounding certain ESG issues, and shifting investor sentiment.

Special Meeting Shareholder Proposals

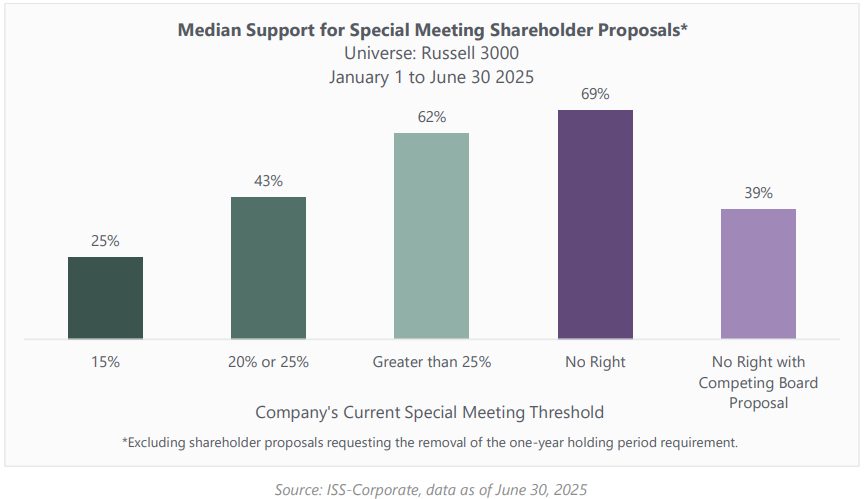

Shareholder proposals requesting the adoption of special meeting rights or a reduction of the current share ownership threshold were the most common shareholder resolution voted on this proxy season; 74 resolutions were submitted, and shareholders were able to cast their votes on 61 of them. An important nuance is that shareholder support was impacted by the company’s existing threshold for calling a special meeting; companies with no special meeting right or an ownership threshold above 25% tended to receive the most robust shareholder support.

Among special meeting proposals, 23 resolutions requested the one-year holding period requirement be removed. Each of these received less than 20% support, regardless of the company’s current ownership threshold.

DExit: Rethinking Delaware

Issuers mulling reincorporation to states other than Delaware captured attention during the proxy season due to a variety of factors, such as newsworthy DExit by high-profile companies and Delaware’s efforts to reiterate its friendliness as a corporate domicile.

As we observed in an April post, DExit: Signs of Discontent in Biggest Corporate Domicile?, the actual number of management proposals seeking to reincorporate to states other than Delaware has remained relatively low in 2025. About 60% of U.S. corporations are currently incorporated there.

As of June 30, just 18 corporate managements proposed reincorporating from Delaware to other states in 2025. The majority of those (12) sought to reincorporate in Nevada, which may be perceived as a choice that provides a balance between tax savings, “flexibility,” and “a predictable, statute-focused legal environment” [1] compared with other states seeking to position themselves as attractive alternatives.

Keeping an Eye on AI

Investor enthusiasm for artificial intelligence (AI) continued this proxy season even as some market watchers question the technology’s potential return on investment, and board oversight remains a key area to watch. In 2024, we observed an 84% year-over-year increase in companies that disclosed some form of board oversight of AI. [2] While still a nascent area for many industries, investors’ keen interest implies continued need for oversight, particularly should pressure increase to show profitability.

Further, given the confluence of factors that have impacted views on board composition and diversity in 2025, directors’ skills and expertise may be scrutinized by shareholders more than ever. The recent trend toward emphasizing more “traditional” director skills may reflect a near-term focus on “playing it safe” in uncertain times. In the longer term, that may be perceived as a weakness to shareholders looking to new technology for growth, return on investment, and responsible deployment where risk is sufficiently mitigated.

Shareholder Engagement on the Radar

Engagement between corporate issuers and their shareholders remains important, particularly when vote support for management proposals is flagging or support for shareholder resolutions is on the rise. However, the changing climate this year may cause confusion regarding the necessity or feasibility of this important mechanism.

At the onset of the 2025 proxy season, [3] the U.S. Securities & Exchange Commission (SEC) issued compliance and disclosure interpretation (C&DI) regarding rules for Schedule 13D versus Schedule 13G filings stipulating that should a shareholder recommend specific actions or condition their vote support (explicitly or implicitly) on management’s response, they could be considered to be “influencing control” over the company.

Following that update, some shareholders halted engagements or opted for “listen-only” mode for meetings. It appears many shareholders have since carefully resumed engaging with issuers, though some have not. Shareholder stewardship statements and other public materials often underline that they do not seek to change or influence control over their portfolio companies and act solely in their clients’ best interests.

However, it is more likely than not that boards will experience greater challenges engaging with shareholders, and some shareholders may be less willing to share constructive feedback.

A difficult or uncertain landscape for communication with shareholders does not absolve managements and boards from the responsibility of seeking to understand and address their concerns. Even if shareholders become less transparent, issuers are still able to access additional information to better understand specific shareholders’ stewardship principles, their past priorities, voting patterns at other companies, and other salient data from reliable outside sources.

Also, particularly for issuers that have experienced low or failing vote support for 2025 ballot items, planning to provide detailed disclosure of their efforts to engage with shareholders (including the percentage that ultimately chose not to engage at all) will likely be a key issue for next year’s proxy season.

1“The U.S. Reincorporation Race: Who’s in the Lead?”, ISS Governance Research, July 14, 2025, accessed Sept. 8, 2025(go back)

2“AI in Focus in 2025: Boards and Shareholders Set Their Sights on AI,” ISS-Corporate, Mar. 20, 2025(go back)

3“2025 U.S. Proxy Season Preview: Navigating Complexity in a Changed World,” ISS-Corporate, Mar. 4, 2025(go back)

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.